The recommended way to find affordable Suzuki Forenza insurance is to regularly compare prices from providers in Toledo.

- Try to learn about what is in your policy and the modifications you can make to prevent high rates. Many policy risk factors that result in higher prices such as getting speeding tickets and a substandard credit score can be eliminated by making minor changes in your lifestyle. Later in this article we will cover ideas to prevent high rates and get discounts that may be available to you.

- Compare price quotes from exclusive agents, independent agents, and direct providers. Direct companies and exclusive agencies can only give rate quotes from one company like GEICO or Farmers Insurance, while agents who are independent can provide prices from many different companies. Compare rates

- Compare the new quotes to your current policy to see if cheaper Forenza coverage is available. If you can save money and decide to switch, verify that coverage does not lapse between policies.

A good tip to remember is to compare the same liability limits and deductibles on each quote request and and to get prices from all possible companies. This provides an accurate price comparison and and a good selection of different prices.

It goes without saying that auto insurance companies don’t want customers comparing rates. Insureds who compare other prices are highly likely to buy a new policy because there is a great chance of finding a lower-cost company. A study discovered that drivers who regularly compared rates saved approximately $850 each year compared to other drivers who never shopped around.

It goes without saying that auto insurance companies don’t want customers comparing rates. Insureds who compare other prices are highly likely to buy a new policy because there is a great chance of finding a lower-cost company. A study discovered that drivers who regularly compared rates saved approximately $850 each year compared to other drivers who never shopped around.

If saving the most money on auto insurance in Toledo is your intention, learning how to compare insurance can help you succeed in saving money.

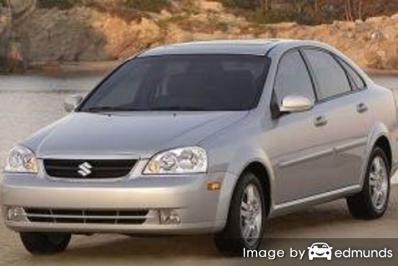

Cheap Suzuki Forenza insurance in Toledo

Some companies don’t always list their entire list of discounts very clearly, so the list below contains some of the more common and also the lesser-known credits available to bring down your rates.

- Discounts for Federal Employees – Having worked for a branch of the government may qualify for a discount when you quote Toledo car insurance but check with your company.

- Discount for Low Mileage – Keeping the miles down on your Suzuki may enable drivers to earn discounted rates on garaged vehicles.

- Homeowners Savings – Being a homeowner can save a few bucks because of the fact that having a home is proof that your finances are in order.

- Bundled Policy Discount – If you can bundle your auto and home insurance and place coverage with the same company you may save as much as 10 to 15 percent.

- No Claims – Insureds who avoid accidents and claims pay less compared to drivers with a long claim history.

- Driver Training Discounts – Successfully completing a course teaching safe driver skills is a good idea and can lower rates depending on where you live.

- Pay Upfront and Save – By paying your policy upfront rather than paying in monthly installments you can actually save on your bill.

- Theft Deterrent – Vehicles with anti-theft systems help deter theft so companies will give you a small discount.

Policy discounts save money, but some of the credits will not apply to the whole policy. Most only reduce the cost of specific coverages such as medical payments or collision. Even though the math looks like you can get free auto insurance, it just doesn’t work that way.

A partial list of companies that may have most of these discounts include:

When comparing rates, check with every company how many discounts you can get. Some credits might not be available to policyholders everywhere. To locate insurance companies that offer many of these discounts in Toledo, click here to view.

Just keep in mind that comparing more quotes increases your odds of finding the best price. Some smaller insurers do not give online rate quotes, so it’s necessary to compare quotes on coverage from those companies, too.

The auto insurance companies shown below provide quotes in Toledo, OH. To find the best cheap auto insurance in OH, we recommend you get rates from several of them to get the lowest price.

Smart Buyers Can Slash Their Insurance Costs

Many factors are used when you get your auto insurance bill. A few of the factors are predictable such as your driving history, although some other factors are not as apparent like your vehicle usage or your financial responsibility.

- Multiple policies with one company – Lots of companies will give discounts to policyholders who buy several policies from them. It’s known as a multi-policy discount. Even if you already get this discount, consumers should still get quotes from other companies to help guarantee you have the best rates. It’s possible to still save more without the discount even if you insure with multiple companies

- Insurance policy lapses increase insurance rates – Driving your car without having proper coverage is a big no-no and companies may charge more for letting your insurance lapse for non-payment. Not only will you pay more, not being able to provide proof of insurance will get you fines or a revoked license.

- Pay less with a high NHTSA crash test rating – Vehicles with high crash test scores cost less to insure. The safest vehicles reduce injuries and lower rates of occupant injuries means less claims paid passed on to you as lower rates. If your Suzuki Forenza is rated at least an “acceptable” rating on the Insurance Institute for Highway Safety website or four stars on the National Highway Traffic Safety Administration website you may be receiving a better rate.

- Influences performance influences auto insurance rates – The performance of the car or truck you need insurance for makes a huge difference in your rates. The lowest performance passenger cars usually are quite affordable to insure, but the cost you end up paying is determined by many additional factors.

- Poor credit decisions can cost you – Having a bad credit rating is likely to be a major factor in determining premium rates. So if your credit history can be improved, you could save money insuring your Suzuki Forenza by repairing your credit. People with high credit scores tend to file fewer claims as compared to drivers with lower credit scores.

- File insurance claims and pay more – Insurance companies in Ohio award discounts to people who only file infrequent claims. If you frequently file small claims, you can definitely plan on either a policy non-renewal or much higher rates. Insurance coverage is designed for major claims that would cause financial hardship.

- Buy as much liability insurance as you can afford – Your insurance policy’s liability coverage will afford coverage if you are responsible for causing personal injury or damage in an accident. Liability provides you with a defense in court which can cost a lot. Liability insurance is pretty cheap compared to other policy coverages, so do not cut corners here.

How much car insurance do I need?

When it comes to buying the best car insurance coverage, there really is no one-size-fits-all type of policy. Each situation is unique so this has to be addressed. For example, these questions may help highlight whether or not you might need professional guidance.

- Is my nanny covered when driving my vehicle?

- Does medical payments coverage apply to all occupants?

- Am I insured when driving a different vehicle?

- What is the difference between personal and commercial auto insurance policies?

- What does roadside assistance cover?

- Do I pay less if my vehicle is kept in my garage?

- Can I insure my car for more than it’s worth?

- Can I rate high risk drivers on liability-only vehicles?

- Am I covered if hit by an uninsured driver?

If it’s difficult to answer those questions but one or more may apply to you, you may need to chat with an insurance agent. To find lower rates from a local agent, take a second and complete this form or go to this page to view a list of companies.

Don’t I need to contact an insurance agency?

A small number of people would prefer to have an agent’s advice and that is a personal choice. The biggest benefit of comparing insurance prices online is the fact that you can find the best rates and also buy local.

To make it easy to find an agent, after completing this form (opens in new window), your coverage information is immediately sent to local insurance agents in Toledo that provide free Toledo car insurance quotes for your coverage. There is no reason to search for any insurance agencies since price quotes are sent to you. You can find the lowest rates AND an agent nearby. If you have a need to compare rates from a specific insurance company, you would need to search and find their rate quote page and fill out their quote form.

To make it easy to find an agent, after completing this form (opens in new window), your coverage information is immediately sent to local insurance agents in Toledo that provide free Toledo car insurance quotes for your coverage. There is no reason to search for any insurance agencies since price quotes are sent to you. You can find the lowest rates AND an agent nearby. If you have a need to compare rates from a specific insurance company, you would need to search and find their rate quote page and fill out their quote form.

Deciding on an provider should include more criteria than just a cheap price quote. Any agent in Toledo should have no problem answering these questions:

- What are the financial ratings for the companies they represent?

- What company holds the largest book of business for them?

- Who are their largest clients?

- Is there a local claims center in Toledo?

- What companies can they write with?

- Will vehicle repairs be made with aftermarket parts or OEM replacement parts?

- By raising physical damage deductibles, how much would you save?

- Do they reduce claim amounts on high mileage vehicles?

If you need to find a good insurance agency, you must know there are a couple different types of agencies that you can choose from. Car insurance agents in Toledo can be categorized as either exclusive or independent (non-exclusive).

Exclusive Agents

Agents that elect to be exclusive work for only one company and some examples include State Farm, Allstate, and Farm Bureau. Exclusive agents cannot shop your coverage around so it’s a take it or leave it situation. Exclusive insurance agents are well schooled on what they offer and that enables them to sell even at higher rates.

Shown below is a list of exclusive insurance agents in Toledo that are able to give rate quotes.

Allstate Insurance: Chuck Bodette

1310 W Sylvania Ave – Toledo, OH 43612 – (419) 478-2400 – View Map

Allstate Insurance: William Swade

2114 N Reynolds Rd – Toledo, OH 43615 – (419) 536-9166 – View Map

American Family Insurance – Doug Zajac

2119 W Sylvania Ave – Toledo, OH 43613 – (419) 472-5154 – View Map

Independent Insurance Agents

Agents that choose to be independent can quote rates with many companies and that gives them the ability to insure through many different car insurance companies and get you the best rates possible. To transfer your coverage to a different company, the agent simply finds a different carrier which requires no work on your part. If you need lower rates, we recommend you get quotes from several independent insurance agents to get the most accurate price comparison.

Below are Toledo independent insurance agencies who can help you get price quotes.

Westgate Insurance

3450 Central Ave #344 – Toledo, OH 43606 – (419) 536-2213 – View Map

Burnor Insurance Agency Inc.

316 N Michigan St – Toledo, OH 43604 – (419) 243-6108 – View Map

Great Lakes Insurance Partners

5215 Monroe St # 2 – Toledo, OH 43623 – (419) 841-2000 – View Map

Insuring your vehicle just makes sense

Despite the high cost, maintaining insurance is required in Ohio but also provides important benefits.

- Almost all states have compulsory liability insurance requirements which means you are required to buy specific limits of liability insurance in order to be legal. In Ohio these limits are 25/50/25 which means you must have $25,000 of bodily injury coverage per person, $50,000 of bodily injury coverage per accident, and $25,000 of property damage coverage.

- If you bought your Suzuki with a loan, it’s guaranteed your bank will require that you have physical damage coverage to guarantee their interest in the vehicle. If you cancel or allow the policy to lapse, the lender may have to buy a policy to insure your Suzuki at a significantly higher premium and make you pay the higher premium.

- Insurance safeguards not only your Suzuki Forenza but also your assets. Insurance will pay for medical expenses for both you and anyone you injure as the result of an accident. Liability coverage will also pay to defend you if you are sued as the result of an accident. If damage is caused by hail or an accident, collision and comprehensive coverages will pay to repair the damage minus the deductible amount.

The benefits of insuring your Forenza more than cancel out the cost, especially for larger claims. Despite what companies tell you, the average driver overpays more than $750 every year so you should quote and compare rates at every policy renewal to help ensure money is not being wasted.

Car insurance company ratings

Choosing the best auto insurance provider can be challenging considering how many different insurance companies sell coverage in Ohio. The ranking information in the lists below may help you pick which insurers you want to consider shopping prices with.

Top 10 Toledo Car Insurance Companies Ranked by Customer Service

- Nationwide

- State Farm

- Safeco Insurance

- American Family

- Titan Insurance

- Travelers

- Liberty Mutual

- GEICO

- Erie Insurance

- Allstate

Top 10 Toledo Car Insurance Companies Overall

- USAA

- 21st Century

- GEICO

- Nationwide

- AAA Insurance

- Liberty Mutual

- Safeco Insurance

- State Farm

- Travelers

- American Family

Keep this in mind when shopping around

We just showed you a lot of ways to compare Suzuki Forenza insurance car insurance rates in Toledo. The key concept to understand is the more you quote Toledo car insurance, the higher your chance of finding affordable Suzuki Forenza insurance quotes. Consumers may even find the lowest car insurance rates are with a smaller regional carrier. These companies can often provide lower premium rates in certain areas than the large multi-state companies such as Allstate and Progressive.

Budget-conscious Suzuki Forenza insurance can be found online as well as from independent agents in Toledo, so you need to shop Toledo car insurance with both to have the best chance of lowering rates. Some companies may not have the ability to get a quote online and most of the time these regional insurance providers only sell coverage through independent agents.

Additional resources

- Electronic Stability Control FAQ (iihs.org)

- Who Has Cheap Auto Insurance Quotes for Postal Workers in Toledo? (FAQ)

- How Much are Toledo Auto Insurance Quotes for Teenage Females? (FAQ)

- How Much is Auto Insurance for a Company Car in Toledo? (FAQ)

- Who Has Cheap Auto Insurance Rates for Drivers with a DUI in Toledo? (FAQ)

- Who Has the Cheapest Toledo Car Insurance Rates for Drivers Requiring a SR22? (FAQ)

- Side Impact Crash Tests (iihs.org)

- New head restraint design cuts injuries (Insurance Institute for Highway Safety)

- Vehicle Size and Weight FAQ (iihs.org)

- Top Signs Your Brakes are Giving Out (State Farm)