It’s hard to fathom, but nearly 70% of drivers kept their coverage with the same insurance company for more than four years, and 38% of customers have never shopped around. Ohio consumers could pocket almost $729 a year, but they don’t know the amount of money they would save if they switched to a more affordable policy.

If saving money is your primary concern, then the best way to save on auto insurance rates is to start doing a yearly price comparison from companies who provide auto insurance in Toledo.

If saving money is your primary concern, then the best way to save on auto insurance rates is to start doing a yearly price comparison from companies who provide auto insurance in Toledo.

- It will benefit you to learn about how your policy works and the factors you can control to drop your rates. Many risk factors that increase rates such as traffic citations, accidents, and a less-than-favorable credit rating can be remedied by improving your driving habits or financial responsibility. Read the full article for instructions to prevent rate hikes and get bigger discounts.

- Get rate quotes from exclusive agents, independent agents, and direct providers. Direct and exclusive agents can only provide price estimates from a single company like Progressive and State Farm, while agents who are independent can provide rate quotes for a wide range of companies.

- Compare the new quotes to your existing policy to see if you can save by switching companies. If you find a lower rate quote and change companies, make sure there is no lapse between the expiration of your current policy and the new one.

One bit of advice is that you use identical deductibles and limits on each quote and and to analyze as many car insurance companies as possible. This guarantees an accurate price comparison and the best rate selection.

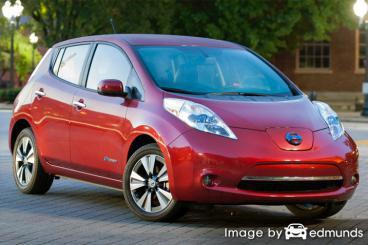

How much does Nissan Leaf insurance in Toledo cost?

Finding a lower price on Nissan Leaf insurance can be surprisingly simple. All you need to do is spend a little time to get quotes to see which company has the cheapest Nissan Leaf rate quotes.

It’s so fast and easy to compare rate quotes online that it makes it obsolete to make phone calls or go to insurance agents’ offices. Comparing Nissan Leaf insurance rates online can eliminate the need for a local agent unless you prefer the advice and guidance of a local Toledo agent. You can, however, compare the best prices online but still have the advice of a local agent.

The following companies offer price comparisons in Ohio. If you want the best car insurance in Ohio, we recommend you visit several of them in order to get a fair rate comparison.

Auto insurance does more than just repair your car

Despite the high insurance cost for a Nissan Leaf in Toledo, auto insurance is mandatory in Ohio but it also protects more than you think.

- Almost all states have mandatory liability insurance requirements which means you are required to carry a minimum amount of liability in order to drive the car. In Ohio these limits are 25/50/25 which means you must have $25,000 of bodily injury coverage per person, $50,000 of bodily injury coverage per accident, and $25,000 of property damage coverage.

- If your Leaf has a loan, almost every bank will make it a condition of the loan that you buy insurance to ensure the loan is repaid in case of a total loss. If coverage lapses or is canceled, the bank may insure your Nissan at a much higher premium rate and require you to reimburse them for the much more expensive policy.

- Auto insurance protects both your Nissan and your personal assets. Insurance will pay for medical transport and hospital expenses that are the result of an accident. Liability insurance, one of your policy coverages, also pays for attorney fees and expenses if you are sued as the result of an accident. If damage is caused by hail or an accident, your policy will cover the damage repairs after a deductible is paid.

The benefits of having auto insurance are without a doubt worth the cost, especially for larger claims. But the average American driver is overpaying over $850 per year so compare rates at least once a year to ensure rates are inline.

Discounts for lower-cost car insurance rates

Car insurance is neither fun to buy or cheap, but there could be significant discounts that can dramatically reduce your bill. Certain discounts will be applied at the time of quoting, but once in a while a discount must be specially asked for prior to receiving the credit.

- Discount for Life Insurance – Not every insurance company offers life insurance, but if they do you may earn lower rates if you buy a life policy as well.

- Defensive Driver Discounts – Participating in a course teaching defensive driver skills may get you a small discount if you qualify.

- Senior Citizen Rates – Older drivers can get lower premium rates.

- Cautious Driver Discounts – Insureds who avoid accidents could pay up to 40% less compared to rates paid by drivers with frequent claims.

- Student Discounts – Getting good grades can get you a discount of up to 25%. This discount can apply well after school through age 25.

- Driver Education Discount – Have your child enroll and complete driver’s education in school or through a local driver safety program.

Remember that most discounts do not apply to the entire policy premium. A few only apply to the price of certain insurance coverages like comp or med pay. Just because you may think you would end up receiving a 100% discount, it just doesn’t work that way.

Companies and some of their more popular discounts are:

- State Farm may offer discounts for good student, Drive Safe & Save, anti-theft, student away at school, defensive driving training, and Steer Clear safe driver discount.

- Farmers Insurance policyholders can earn discounts including pay in full, multi-car, distant student, mature driver, good student, and alternative fuel.

- Progressive offers discounts for online quote discount, online signing, multi-vehicle, homeowner, and multi-policy.

- GEICO offers discounts including air bags, anti-lock brakes, multi-vehicle, seat belt use, and emergency military deployment.

- Auto-Owners Insurance includes discounts for paid in full, mature driver, student away at school, good student, company car, and group or association.

- The Hartford may have discounts that include air bag, anti-theft, good student, defensive driver, bundle, and vehicle fuel type.

- Farm Bureau has discounts for 55 and retired, youthful driver, driver training, safe driver, and multi-vehicle.

- USAA discounts include safe driver, vehicle storage, driver training, military installation, family discount, multi-policy, and multi-vehicle.

It’s a good idea to ask every prospective company to apply every possible discount. Some credits may not be offered in your state. For a list of companies that offer many of these discounts in Ohio, click here.

Don’t assume everyone needs the same auto insurance coverage

When quoting and choosing the best auto insurance coverage for your personal vehicles, there isn’t really a “best” method to buy coverage. Your situation is unique and your auto insurance should unique, too.

Here are some questions about coverages that could help you determine whether or not you could use an agent’s help.

- How do I insure my teen driver?

- Is my state a no-fault state?

- Why is insurance for a teen driver so high in Toledo?

- Is business property covered if stolen from my car?

- Am I covered while delivering pizza?

- What are the best liability limits?

- When would I need additional glass coverage?

If you’re not sure about those questions but a few of them apply then you might want to talk to an agent. If you don’t have a local agent, take a second and complete this form or click here for a list of auto insurance companies in your area. It’s fast, doesn’t cost anything and can provide invaluable advice.