Truthfully, the best way to get discount Acura ZDX insurance in Toledo is to begin comparing prices regularly from insurance carriers that sell auto insurance in Ohio.

Truthfully, the best way to get discount Acura ZDX insurance in Toledo is to begin comparing prices regularly from insurance carriers that sell auto insurance in Ohio.

- Gain an understanding of the coverage provided by your policy and the changes you can make to lower rates. Many rating criteria that result in higher prices such as speeding tickets, accidents and bad credit can be improved by making lifestyle changes or driving safer.

- Compare rates from exclusive agents, independent agents, and direct providers. Exclusive agents and direct companies can give quotes from a single company like Progressive or Allstate, while independent agents can quote prices from many different companies.

- Compare the new rate quotes to the premium of your current policy to determine if you can save on ZDX insurance in Toledo. If you find a lower rate quote and make a switch, make sure there is no lapse in coverage.

- Tell your current company to cancel your current car insurance policy and submit the signed application along with the required initial payment to your new agent or company. Immediately place the new proof of insurance paperwork along with your vehicle registration.

A good tip to remember is to try to use identical coverages on each quote request and and to get prices from as many auto insurance providers as possible. Doing this guarantees a level playing field and plenty of rates choose from.

A recent car insurance study revealed that over 70% of drivers renewed their policy with the same company for at least the last four years, and roughly 40% of drivers have never compared rate quotes at all. Drivers in Ohio could save themselves 55% a year, but most undervalue the big savings they would realize if they switched.

Quoting and buying the best-priced policy in Toledo is not as confusing as people think. Essentially anyone who shops for auto insurance should be able to lower their premiums. But Ohio vehicle owners benefit from understanding how the larger insurance companies compete online because it can help you find the best coverage.

Save money with these discounts

Car insurance companies don’t always advertise all possible discounts very well, so the following is a list of both well-publicized and also the more inconspicuous discounts that may be available.

- Telematics Data Discounts – Policyholders that allow data collection to scrutinize where and when they drive by using a telematics device like Allstate’s Drivewise could save a few bucks if they have good driving habits.

- Student Discounts – Getting good grades may save as much as 25% on a Toledo auto insurance quote. Most companies allow this discount until age 25.

- Driver Safety – Taking a course that instructs on driving safety is a good idea and can lower rates and make you a better driver.

- Accident Forgiveness – This one isn’t a discount, but some insurance companies will let one accident slide without getting socked with a rate hike so long as you are claim-free prior to the accident.

- Savings for New Vehicles – Putting insurance coverage on a new ZDX can save you some money because newer models are generally safer.

- Toledo Homeowners Pay Less – Owning a house in Toledo can get you a discount since owning and maintaining a home is proof that your finances are in order.

- Theft Deterrent – Vehicles that have factory alarm systems and tracking devices are stolen less frequently and can earn a small discount on your policy.

One last thing about discounts, most of the big mark downs will not be given to the entire cost. Most only reduce individual premiums such as collision or personal injury protection. So when it seems like you could get a free car insurance policy, that’s just not realistic.

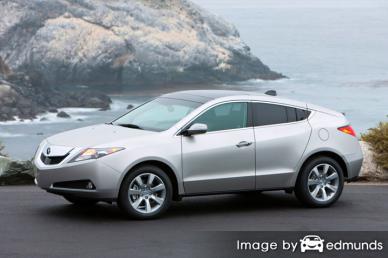

The chart below shows the difference between Acura ZDX insurance costs with and without policy discounts. The information is based on a female driver, no claims or violations, Ohio state minimum liability limits, comp and collision included, and $1,000 deductibles. The first bar for each age group shows premium with no discounts. The second shows the rates with multi-car, homeowner, marriage, claim-free, safe-driver, and multi-policy discounts applied.

To locate car insurance companies that offer many of these discounts in Ohio, click here to view.

The method we recommend to compare insurance rates from multiple companies is to take advantage of the fact car insurance companies provide online access to compare their rates. To start a quote, the only thing you need to do is give the companies some data like the type of vehicles you drive, deductibles desired, whether or not you need a SR-22, and an estimate of your credit level. Your details is submitted instantly to multiple insurance providers and you receive quotes within a short period of time.

If you would like to start a quote now, click here and enter your zip code.

The providers in the list below are our best choices to provide price comparisons in Toledo, OH. To buy cheap car insurance in Ohio, we recommend you visit several of them in order to find the lowest rates.

Analysis of coverages

The premium table displayed below highlights estimates of prices for Acura ZDX models. Knowing how rates are established can help you make smart choices when choosing a car insurance company.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| ZDX Technology Package AWD | $180 | $298 | $234 | $14 | $70 | $796 | $66 |

| ZDX AWD | $180 | $298 | $234 | $14 | $70 | $796 | $66 |

| ZDX Advance Package AWD | $180 | $336 | $234 | $14 | $70 | $834 | $70 |

| Get Your Own Custom Quote Go | |||||||

Above prices assume married male driver age 40, no speeding tickets, no at-fault accidents, $500 deductibles, and Ohio minimum liability limits. Discounts applied include multi-policy, safe-driver, homeowner, claim-free, and multi-vehicle. Rates do not factor in specific garaging location which can impact insurance rates considerably.

Physical damage deductibles: Should you raise them?

One of the more difficult decisions when buying car insurance is the level to set your comp and collision deductibles. The rates below can help you understand the differences in price when you choose different deductibles. The first set of rates uses a $250 comprehensive and collision deductible and the second pricing table uses a $500 deductible.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| ZDX Technology Package AWD | $244 | $400 | $226 | $14 | $68 | $977 | $81 |

| ZDX AWD | $244 | $400 | $226 | $14 | $68 | $977 | $81 |

| ZDX Advance Package AWD | $244 | $454 | $226 | $14 | $68 | $1,031 | $86 |

| Get Your Own Custom Quote Go | |||||||

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| ZDX Technology Package AWD | $198 | $324 | $226 | $14 | $68 | $830 | $69 |

| ZDX AWD | $198 | $324 | $226 | $14 | $68 | $830 | $69 |

| ZDX Advance Package AWD | $198 | $366 | $226 | $14 | $68 | $872 | $73 |

| Get Your Own Custom Quote Go | |||||||

Prices based on married male driver age 30, no speeding tickets, no at-fault accidents, and Ohio minimum liability limits. Discounts applied include safe-driver, multi-policy, multi-vehicle, homeowner, and claim-free. Price information does not factor in the specific area where the vehicle is garaged which can change premiums significantly.

We can estimate from the data above that using a $250 deductible will cost in the ballpark of $13 more each month or $156 every year than requesting the higher $500 deductible. Because you would pay $250 more to file a claim with a $500 deductible as compared to a $250 deductible, if you average at a minimum 19 months between claim filings, you would probably come out ahead if you opt for a higher deductible. Here is the way we made this calculation.

| Average monthly premium for $250 deductibles: | $83 |

| Average monthly premium for $500 deductibles (subtract): | – $70 |

| Monthly savings from raising deductible: | $13 |

| Difference between deductibles ($500 – $250): | $250 |

| Divide difference by monthly savings: | $250 / $13 |

| Number of months required between physical damage coverage claims in order to save money by choosing the higher deductible | 19 months |

The example below shows how different deductible levels and can change Acura ZDX annual premium costs for each different age category. The prices are based on a married male driver, full physical damage coverage, and no other discounts are factored in.

Yearly car insurance costs for men versus women

The diagram below visualizes the comparison of Acura ZDX insurance prices for male and female drivers. The rates are based on no violations or claims, comp and collision included, $500 deductibles, drivers are not married, and no discounts are factored in.

Auto insurance can get complicated

When quoting and choosing the best auto insurance coverage for your vehicles, there really isn’t a best way to insure your cars. Each situation is unique and your auto insurance should unique, too.

For example, these questions can help discover if your situation would benefit from professional advice.

- Are there companies who specialize in insuring high-risk drivers?

- How can I get the company to pay a claim?

- Do I benefit by insuring my home with the same company?

- Is a new car covered when I drive it off the dealer lot?

- What does medical payments coverage do?

- Do I need more liability coverage?

- Is borrowed equipment or tools covered if stolen or damaged?

- What is PIP insurance?

- Does my insurance cover my expensive audio equipment?

If you’re not sure about those questions then you might want to talk to a licensed insurance agent. If you want to speak to an agent in your area, take a second and complete this form or you can go here for a list of companies in your area.

Buying car insurance from Toledo auto insurance agents

A lot of people still like to buy from a local agent and that can be a smart move A nice benefit of comparing rate quotes online is the fact that you can find cheap car insurance quotes and still choose a local agent. And providing support for neighborhood agents is especially important in Toledo.

After filling out this simple form, the coverage information is transmitted to agents in your area who will give you bids and help you find cheaper coverage. You don’t have to leave your computer as quotes are delivered immediately to you. You can most likely find cheaper rates AND a local agent. If you need to quote rates for a specific company, you would need to visit that company’s website and complete a quote there.

The different types of car insurance agents

If you’re trying to find a local Toledo insurance agency, you must know there are a couple types of agencies and how they work. Insurance agencies in Toledo can be categorized as either independent or exclusive depending on the company they work for.

Independent Agents (or Brokers)

Independent agencies often have many company appointments and that allows them to write policies through many companies depending on which coverage is best. To move your coverage to a new company, an independent agent can move your coverage and you can keep the same agent.

When comparing rates, you will want to get insurance quotes from multiple independent agents to get the best comparison. Most independent agents also contract with companies that do not advertise much that many times have cheaper rates.

Shown below is a small list of independent agencies in Toledo that may be able to give you price quotes.

- Powell Insurance Inc

6029 Renaissance Pl # A – Toledo, OH 43623 – (419) 882-1076 – View Map - Detlef Insurance

833 Woodville Rd – Toledo, OH 43605 – (419) 693-7458 – View Map - Regan Insurance

3034 W Sylvania Ave – Toledo, OH 43613 – (419) 292-0001 – View Map

Exclusive Insurance Agencies

Exclusive insurance agents generally can only insure with one company like Allstate, AAA, Farmers Insurance, and State Farm. Exclusive agents are unable to provide rate quotes from other companies so it’s a take it or leave it situation. Exclusive insurance agents receive extensive training on their company’s products which can be an advantage. Some insured continue to buy insurance from these agents primarily because of the brand legacy instead of buying on price only.

Listed below is a short list of exclusive agencies in Toledo that can give you price quotes.

- Allstate Insurance: Evans Insurance Group Corp.

1900 Monroe St – Toledo, OH 43604 – (419) 241-8061 – View Map - Allstate Insurance: William Swade

2114 N Reynolds Rd – Toledo, OH 43615 – (419) 536-9166 – View Map - American Family Insurance – Doug Zajac

2119 W Sylvania Ave – Toledo, OH 43613 – (419) 472-5154 – View Map

Finding a good insurance agent is decision based upon more than just the quoted price. These are some questions your agent should answer.

- What insurance companies do they recommend if they are an independent agent?

- Are claims handled at the agent’s location?

- Will you get a loaner vehicle if you car is being repaired?

- Will your rates increase after a single accident?

- Do you work with a CSR or direct with the agent?

- Can glass repairs be made at your home?

One last note

Some auto insurance companies may not have rate quotes online and most of the time these small insurance companies only sell coverage through local independent agencies. Lower-priced auto insurance in Toledo is available on the web and also from your neighborhood Toledo agents, and you need to price shop both so you have a total pricing picture.

As you prepare to switch companies, don’t be tempted to skimp on critical coverages to save a buck or two. In many cases, an insured dropped full coverage only to find out that the small savings ended up costing them much more. Your objective should be to purchase a proper amount of coverage at the lowest possible cost and still be able to protect your assets.

Even more information is located by following these links:

- What is Gap Insurance? (Insurance Information Institute)

- Who Has Affordable Toledo Auto Insurance for Infrequent Drivers? (FAQ)

- Who Has Cheap Toledo Auto Insurance for a Learners Permit? (FAQ)

- What Does No-Fault Insurance Cover? (Allstate)

- How to Avoid Buying a Flooded Car (Insurance Information Institute)